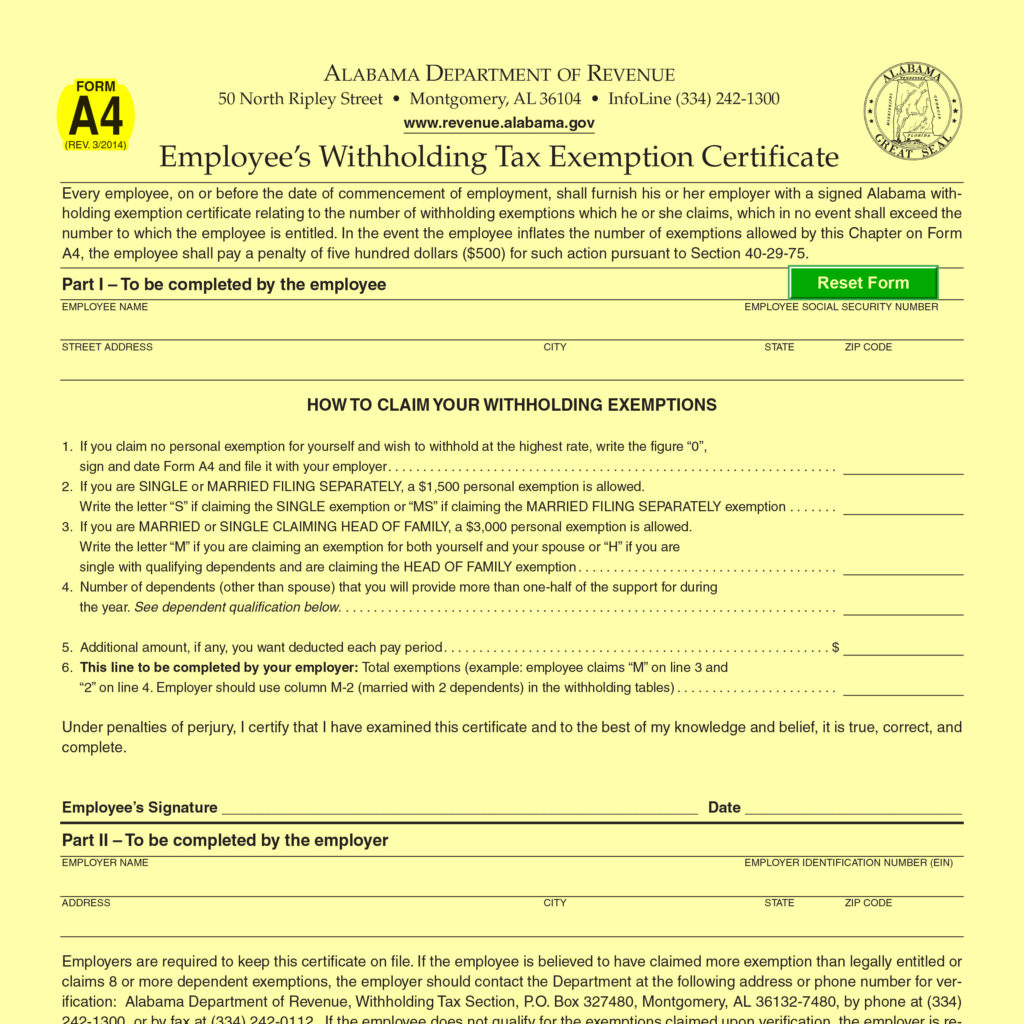

Alabama Estimated Tax Form 2025 - You can quickly estimate your alabama state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. The 2025 tax rates and thresholds for both the alabama state tax tables and federal tax tables are comprehensively integrated into the. Alabama Tax 19972025 Form Fill Out and Sign Printable PDF Template, You expect to owe at least $500 in tax for 2025, after subtracting your withholding and.

You can quickly estimate your alabama state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. The 2025 tax rates and thresholds for both the alabama state tax tables and federal tax tables are comprehensively integrated into the.

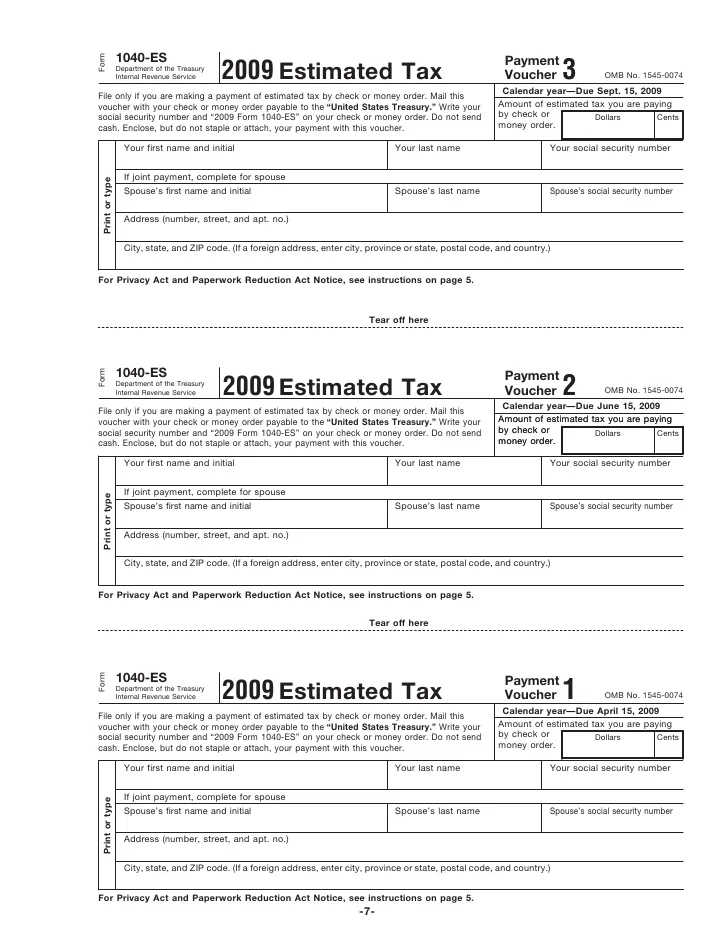

Alabama Estimated Tax Form 2025. 29 with a filing deadline for individual income tax returns of april 15. Estimated tax payment due dates 2025.

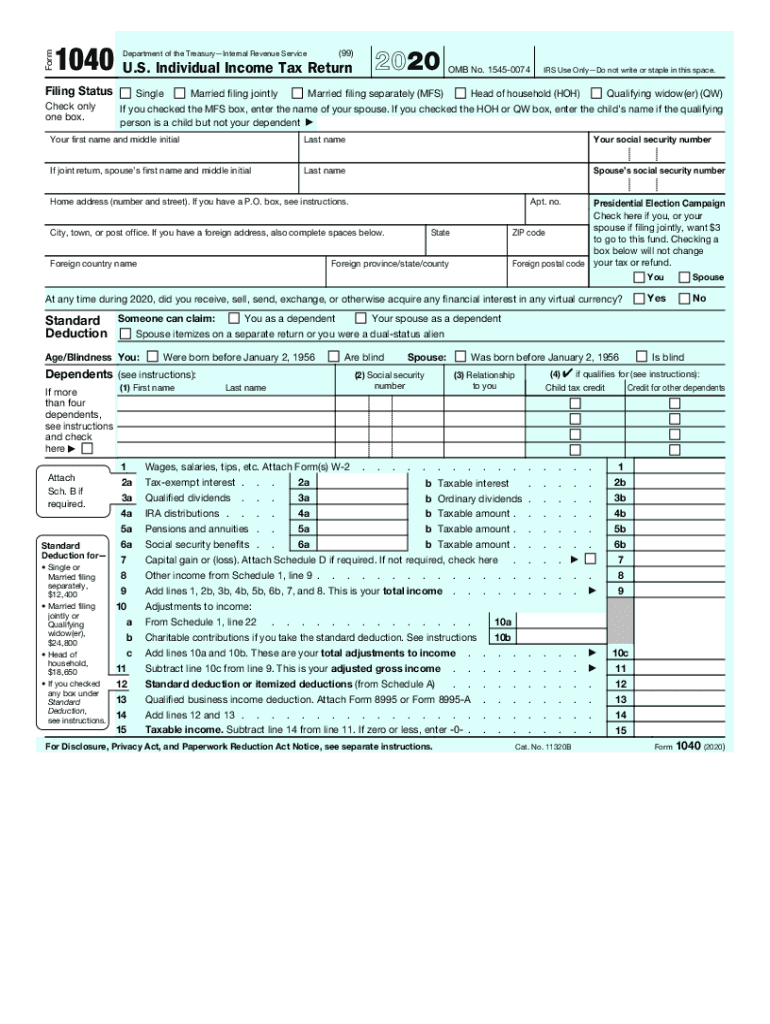

Irs Tax Forms 2025 Printable Free Pdf File Gabbey Emmalee, The state income tax in alabama is similar to the federal income tax, with increasing rates based on income brackets.

Estimated Tax Form Alabama Free Download, April 15, 2025, june 17, 2025, september 16, 2025,.

Alabama state tax Fill out & sign online DocHub, The free online 2025 income tax calculator for alabama.

Alabama Tax Schedule 2025 Kandy Mariska, Details on how to only prepare and.

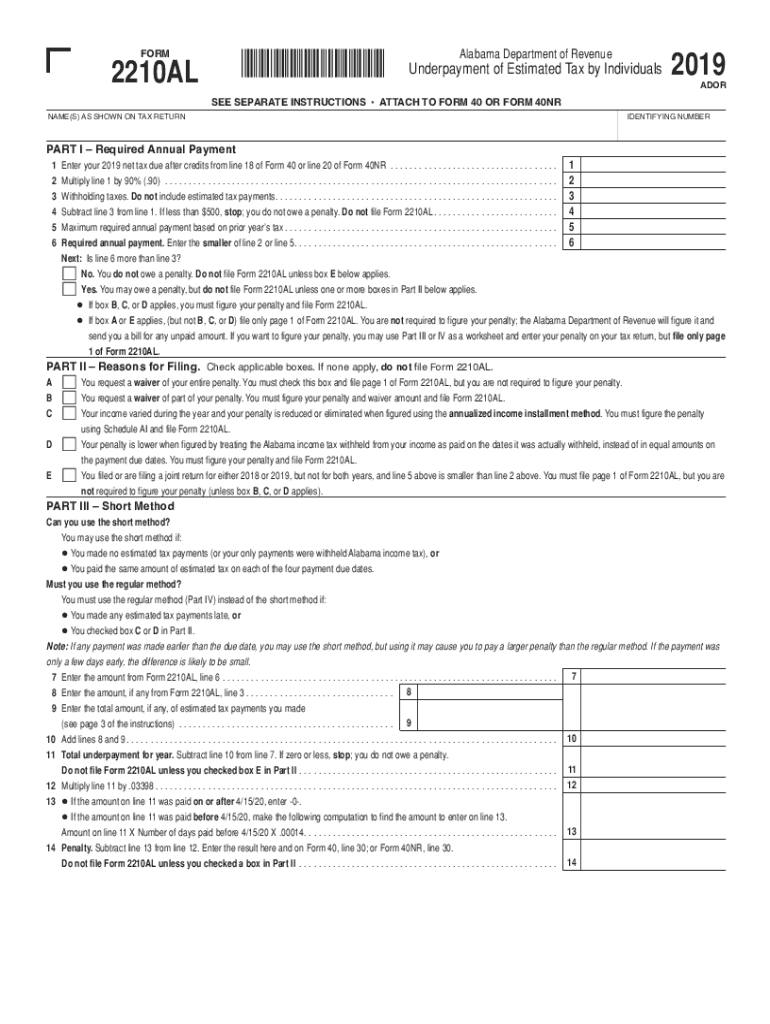

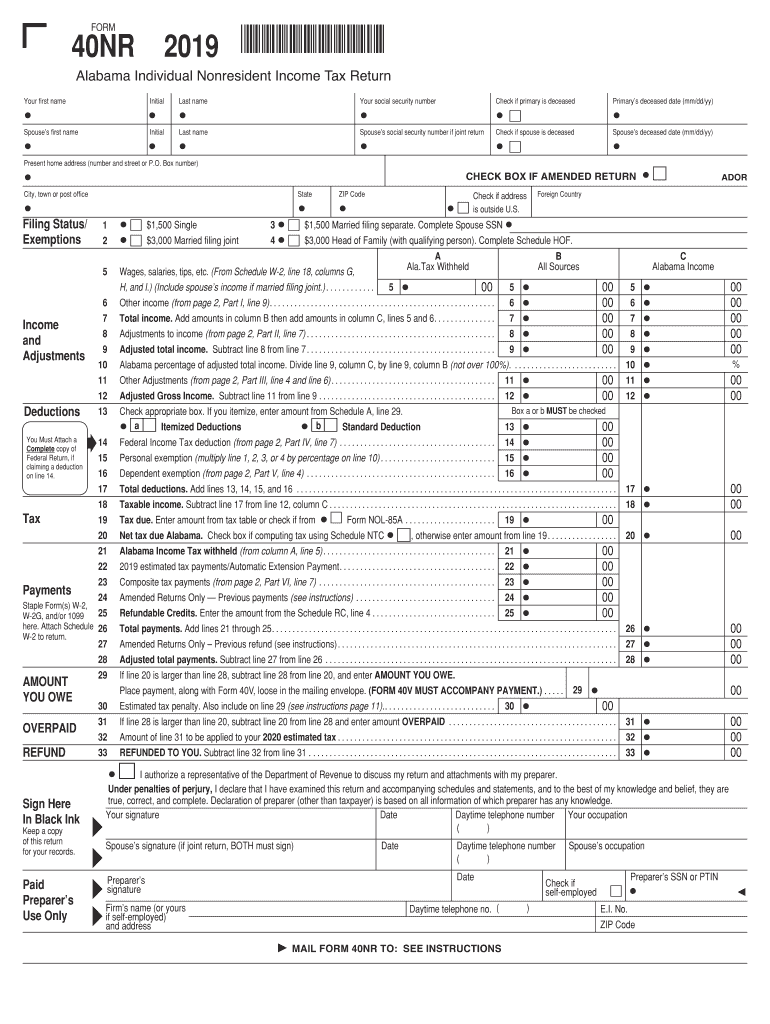

Printable Alabama Form 2210AL Estimated Tax Penalties for Individuals, Individual income estimated tax forms:

2025Es 2025 Estimated Tax Payment Vouchers Delora Kendre, 2025 tax calculator for alabama.

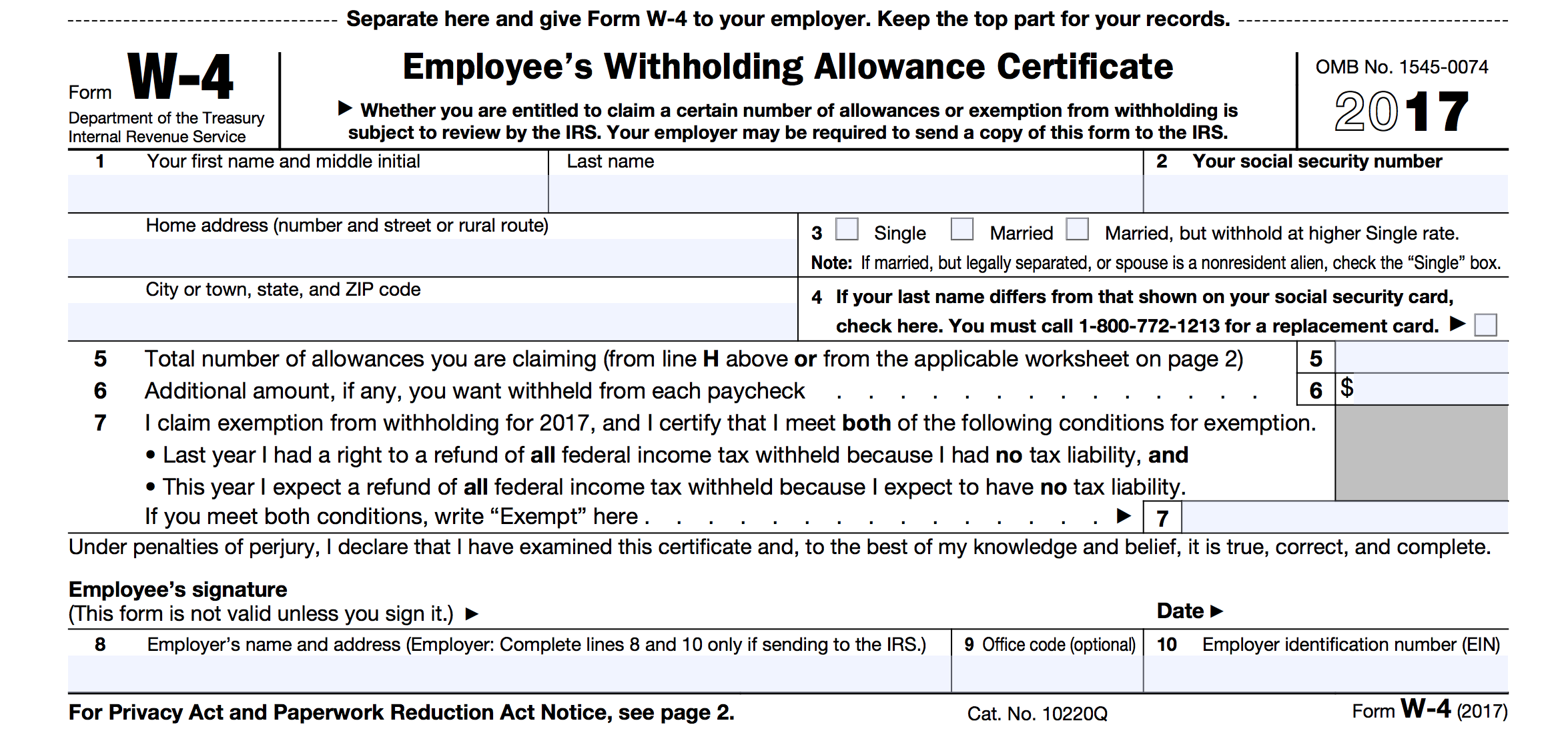

Alabama State Tax Withholding Form 2022 W4 Form, The free online 2025 income tax calculator for alabama.

Alabama quarterly tax form Fill out & sign online DocHub, The alabama tax estimator lets you calculate your state taxes for the tax year.

Printable 2025 2025 Tax Forms Printable Dulsea Lillian, Corporations are required to pay estimated income tax if the corporation’s income tax less any credits for the taxable year can reasonably be expected to be $500 or more.